Collector Penalties

Luckily for consumers, financial policy violations come with real penalties for creditors. The biggest creditors have all been hit with these penalties (think Wells Fargo, Bank of America). Familiarizing yourself with your rights and what constitutes a violation can go a long way in protecting your financial interests.

TILA:

Truth in Lending Act

To assure a meaningful disclosure of credit terms, TILA requires

creditors to provide consumers with a uniform system of

disclosures that clearly and concisely informs consumers of

their credit terms.

CFPA:

Consumer Financial Protection Act

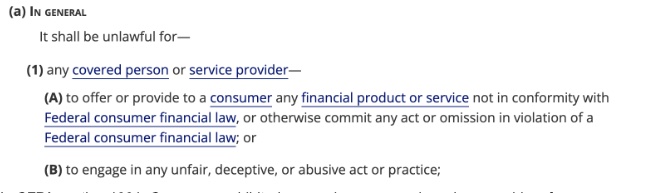

Section 1036(a)(1)(B), 12 U.S.C. 5536(a)(1)(B)

In CFPA section 1031, Congress prohibited covered persons and services providers from committing or engaging in unfair, deceptive, or abusive acts or practices in connection with the offering or provision of consumer financial products or services.

FDCPA:

Monetary and Non-Monetary Damages

- Damages for physical distress - one can recover the costs of treatment from the collector

- Damages for emotional distress

- Lost wages recovered - if the collector is calling at place of employment and it has in any way affected their wages, then the debtor can ask for the wages to be awarded to them

-

Statutory Damages for up to $1,000 - the court can award these

damages if the consumer proves the collector violated the

FDCPA, but the consumer does not have to prove that the

violation caused any harm. This $1,000 is per lawsuit - not

per violation - so if the creditor violates the FDCPA once or

multiple times, the consumer still only collects up to $1,000.

This includes: - Repeated phone calls

- The use of abusive or profane language

- Calling during prohibited times

- Threatening or using violence

- Contacting a third party about your debt

- Contacting you at work

- Lying or misleading you about your debt

- Failing to provide verification of your debt

- Failing to identify themselves as a debt collector

- In addition to awarding a consumer monetary damages, a court can also order the debt collector to cease certain activities—this is called "injunctive relief." For example, the court can require that:

- Debt collector stop calling

- Debt collector stop sending letters

- Any family members, coworkers, or friends of a debtor who has been affected by the third party debt collector can also sue for damages (up to $1,000)

TCPA:

https://www.fcc.gov/sites/default/files/tcpa-rules.pdf

- A consumer can recover up to $500 for each violation of the Do Not Call Registry.

- Up to $500 per violation, and up to $1,500 per violation if the consumer can show that the TCPA was violated knowingly and willfully.

- There isn’t a maximum cap on these violations, unlike FDCPA violations.

- The statute of limitations for TCPA cases is four years.